japan corporate tax rate history

The corporate tax is made up of 3 main taxes which are all based on the annual taxable income of the company. Dec 2014 Japan Corporate tax rate.

Analysis Japan To Raise Consumption Tax In October Foreigner Spending Expected To Boost Travel Retail Revenues The Moodie Davitt Report The Moodie Davitt Report

5 Standard rate 123 percent of the central tax.

. Companies with paid-in capital of over 100 million JPY are subject to a corporate income tax rate of 232. Enterprise tax and special local corporate tax are taxed based on corporate tax amount of a company however corporations with paid-in capital of more than 100 million Japanese yen are. Measures the amount of taxes that Japanese businesses must pay as a.

The tax is levied at a progressive rate up to 55 based on the fair market value of the estate or inherited assets minus funeral expenses and any debts exemptions or allowances related to. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Foreign companies having Permanent Establishment in India 40 applicable surcharge and cess Please refer.

6 The special local tax is 81 percent of the prefectural enterprise tax for. For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. The maximum rate of 147 percent is levied in Tokyo metropolitan.

115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate. Outline of Other Income Deductions Income Tax Tax Rate. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching.

For any domestic corporation registered in Japan both for domestic and subsidiaries of foreign companies a corporate tax on national level is levied by the National Tax Agency an integral. Those companies with paid-in capital less than 100 million JPY are. Enterprise Tax which is also a local tax The current.

Beginning from 1 October 2019 corporate taxpayers are required. Japan Corporate tax rate. Since then the rate peaked at 528 in.

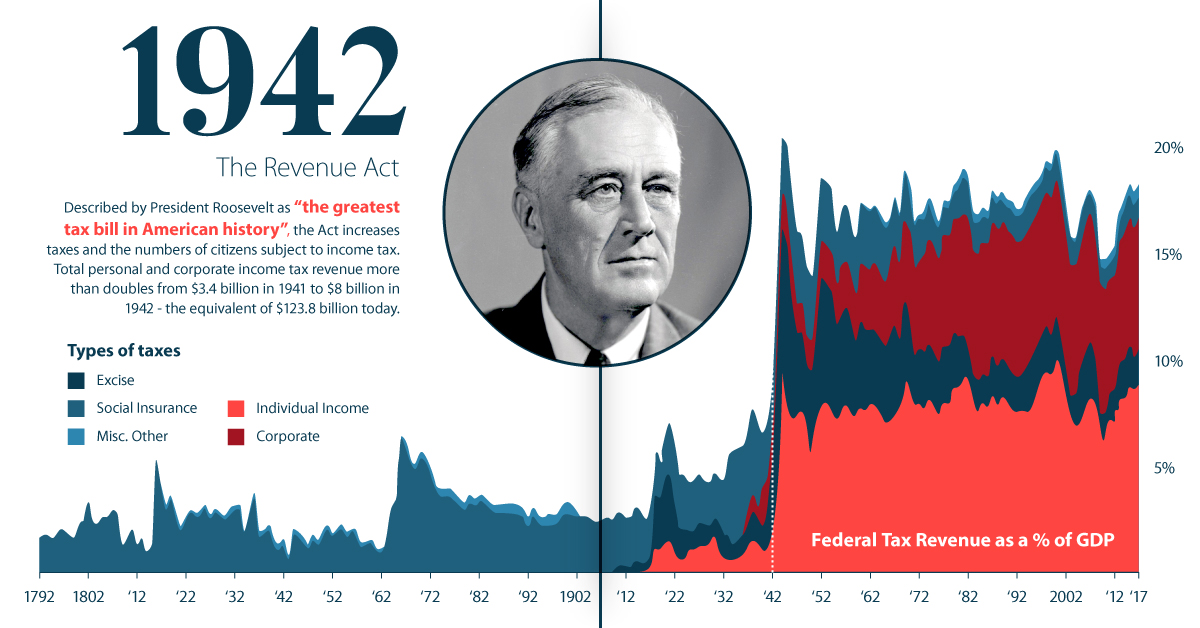

Structure of Income Tax of Japan illustrative purposes only Types and Outlines of Personal Deductions. The federal corporate income tax was fist implemented in 1909 when the uniform rate was 1 for all business income above 5000. Corporate tax rate in japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Corporate Inhabitant taxes 1. 7 rows National local corporate tax. Measures the amount of taxes that Japanese businesses must pay as a share of corporate.

15 or 22 applicable surcharge and cess subject to certain conditions.

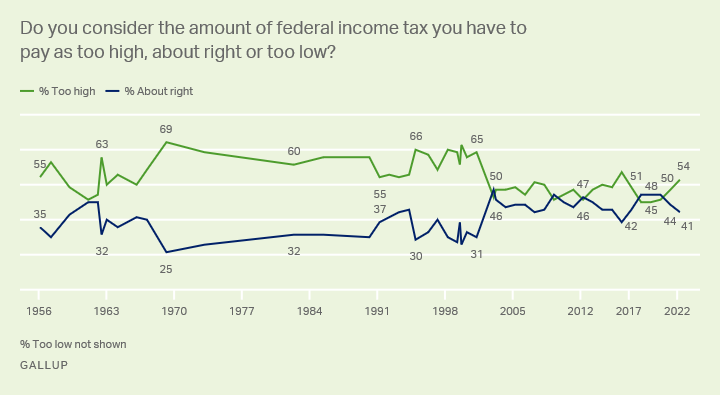

Taxes Gallup Historical Trends

Toward Meaningful Tax Reform In Japan Cato Institute

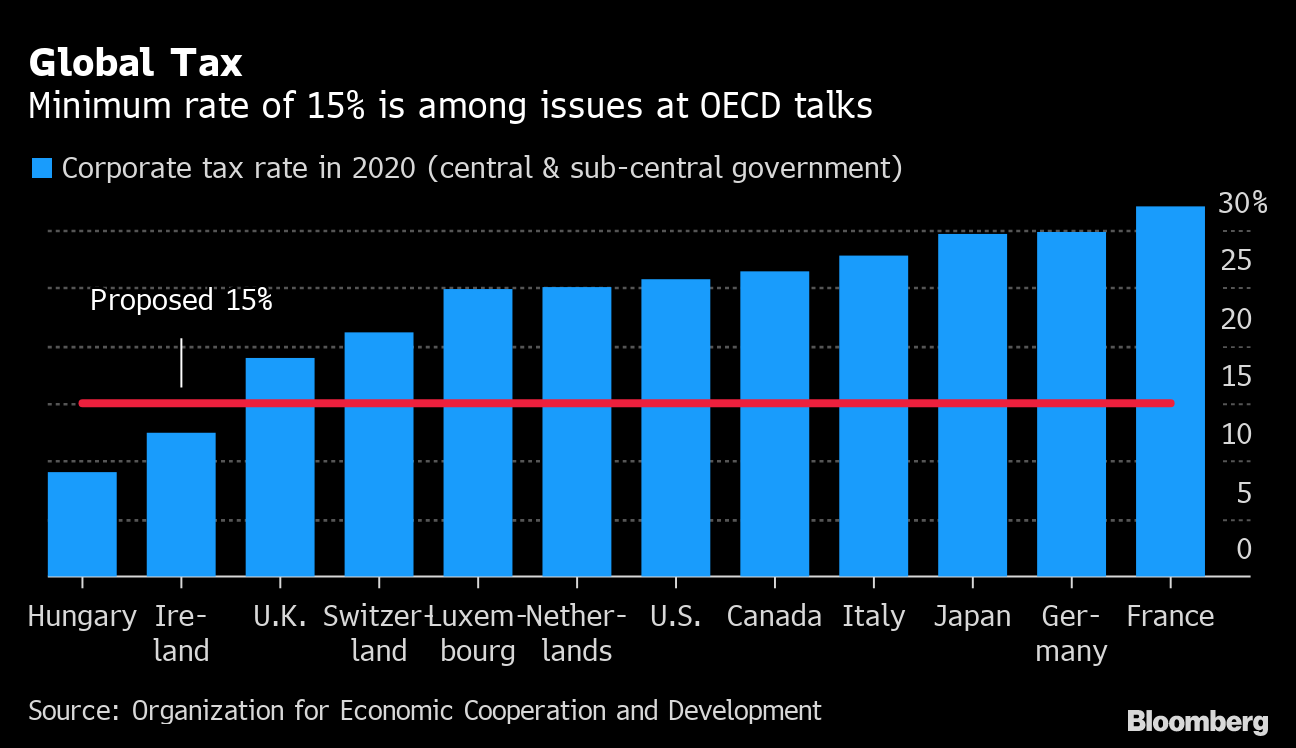

The Global Tax Deal For Tech Giants Is Delayed To 2024 Bloomberg

Infographic A History Of Revolution In U S Taxation

Japan S Kan Seeks Corporate Tax Cut Wsj

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Corporate Tax Laws And Regulations Report 2022 Japan

Corporate Tax Rate In Japan Ventureinq Accounting Firm In Japan Tokyo

Wealth Management Domestic And International Taxation Services Tokyo Kyodo Accounting Office Accounting Firm Where Accounting And Tax Professionals Gather

The History Of Taxes Here S How High Today S Rates Really Are

How Do Us Taxes Compare Internationally Tax Policy Center

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

Taxation Defined With Justifications And Types Of Taxes

Changes In Corporate Effective Tax Rates During Three Decades In Japan Sciencedirect

As Some Major Economies Cut Their Corporate Tax Rates What Will Happen Next World Economic Forum

India Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

Japan Corporate Tax System Rates Branch Subsidiary Company Kk Gk

How Do Us Taxes Compare Internationally Tax Policy Center

Chart Uk Tax Burden To Hit Highest Level Since The 60s Statista